Top Stories

South Africa’s Economic Rally Faces Challenges Amid High Unemployment

The recent surge in South African assets, dubbed the “everything rally,” is drawing attention as it faces potential challenges due to the nation’s persistently high unemployment rate and sluggish economic growth. Despite a substantial increase in stocks, bonds, and the currency, experts warn that without a significant uptick in economic performance, this rally may not be sustainable.

This year, South Africa’s benchmark equity index saw a remarkable increase of approximately 46% in dollar terms, while local-currency government debt has outperformed the emerging-market average. The South African rand is poised for its strongest performance against the US dollar since 2022. These gains have been bolstered by soaring commodity prices and government reforms aimed at revitalizing the economy.

However, according to Hendrik du Toit, chief executive of Ninety One Plc, which manages assets worth about 3.5 trillion rand (approximately $202 billion), these improvements may not be enough to maintain momentum. He noted that with gross domestic product (GDP) growth struggling to exceed 1% and nearly a third of the working-age population unemployed, it will be difficult for companies to generate profits that justify current market valuations.

The latest budget update from Finance Minister Enoch Godongwana offered some positive news, with revenue expectations surpassing earlier forecasts. In a notable response, S&P Global Ratings upgraded South Africa’s credit rating for the first time since 2005. The end of frequent power cuts and efforts to address logistical issues hindering exports have contributed to a more optimistic economic outlook.

Despite these developments, the country has faced significant challenges over the past decade, including electricity shortages, political instability, and rising living costs. The National Treasury anticipates GDP growth will accelerate to an average of 1.8% over the next three years, yet investors remain cautious regarding the realization of this forecast.

During a recent business summit, Daniel Pinto, Vice Chairman of JPMorgan Chase & Co., emphasized the need for structural reforms that focus on job creation. He stated, “The government is doing some of the right things, and if reform deepens, the informal economy will shrink and living standards will improve.”

The FTSE/JSE Africa All Share Index is on track for its best performance since 2006, outpacing the emerging market benchmark and major global indices. A surge in the prices of gold, silver, and platinum has propelled the index of precious-metals miners more than 180%. In a recent survey conducted by Bank of America Corp., 75% of fund managers expressed bullish sentiment towards South African equities, up from 69% earlier in the year.

Investment in sectors such as banking, retail, and renewable energy is expected to lead the next stage of this rally, contingent on continued government reforms to unlock economic growth. Du Toit remarked on the potential for South African companies, highlighting that approximately $100 billion is held on balance sheets that could be released with regulatory changes.

The bond market has also seen favorable trends, supported by moderating inflation and lower interest rates. South African government bonds have provided a return of around 32% in dollar terms this year, significantly outpacing other local currency debt indices. As foreign investment increases, with net inflows of 175 billion rand during the year to October, the potential for further growth remains.

Despite the positive momentum, some investors caution that future gains may be limited. Yields on 10-year government bonds have decreased by more than 170 basis points this year, nearing record lows. David Austerweil, an emerging markets deputy portfolio manager at Van Eck Associates Corp., noted, “We’ve moved to market weight in South African government bonds after having been very overweight all year, given major catalysts have been realized and bond valuations are less cheap.”

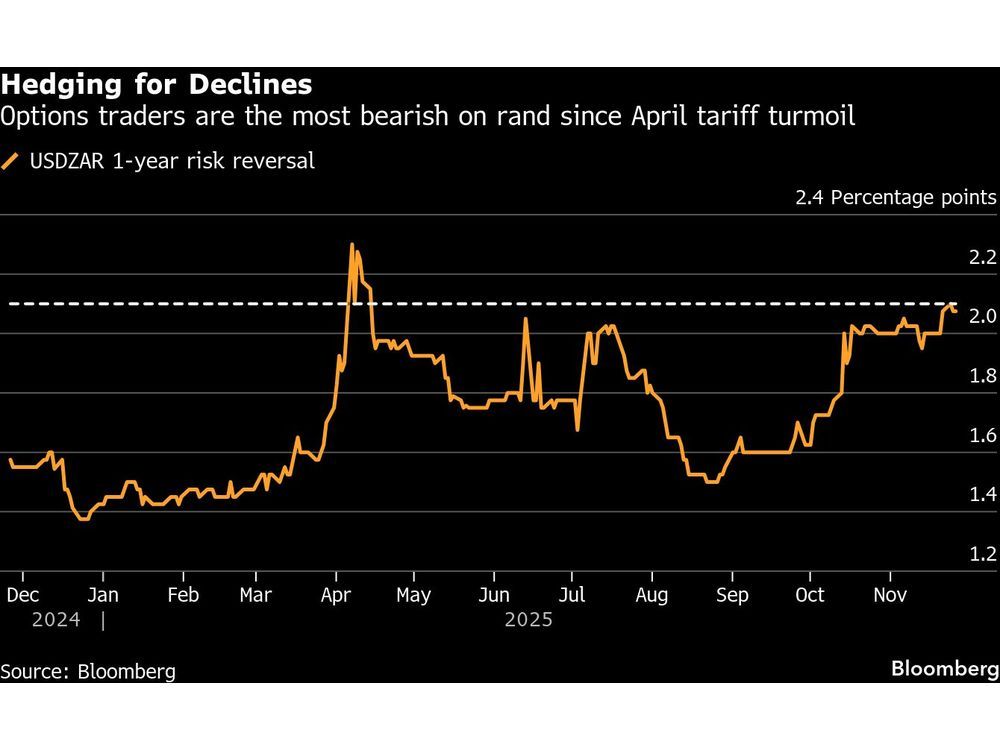

The South African rand has appreciated by 10% against the dollar this year, benefiting from improved commodity export values and attractive interest rate differentials. However, traders are beginning to adopt a more cautious stance, using options to hedge against potential declines in the currency’s value. The market forecasts assign a 54% probability of the rand weakening over the next year.

While key financial assets have already integrated a significant amount of positive news, analysts emphasize that deeper policy reforms are necessary for sustainable economic improvement. Lester Davids, an analyst at Unum Capital Ltd., stated, “Once the growth engine moves, capital will flow. South Africa has advantages. It’s not that difficult, but we have to get the basics right.”

As South Africa navigates its economic landscape, the intertwining of reforms, investment, and growth will be crucial in determining the future direction of its asset markets.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey