Top Stories

Debt Swaps Evolve: From Conservation to Reconstruction Efforts

Debt swaps, originally pioneered by Credit Suisse to finance nature conservation projects, are finding new relevance in the context of geopolitical conflicts and energy security. This financial mechanism allows governments to refinance existing debt under more favorable terms, redirecting any resultant savings toward specific policy objectives. As the global landscape shifts, bankers are exploring the potential of these swaps for applications beyond environmental goals, with predictions of as many as four new swaps being finalized by the end of 2025, according to Jake Harper, senior investment manager at Legal & General Group Plc.

In recent months, there has been a noticeable shift in the focus of these swaps. While they initially aimed at nature conservation, the current environment has prompted a broader interpretation of their potential. This aligns with the growing emphasis on ESG (environmental, social, and governance) criteria, as investors and issuers begin to align their financial strategies with pressing global issues, such as reconstruction efforts in war-torn areas. A prominent example of this is Citigroup Inc.’s initiative to facilitate the rebuilding of Ukraine post-conflict.

Antonio Navarro, a former banker at Credit Suisse and co-founder of ArtCap Strategies, highlights that the structural design of debt swaps makes them particularly effective in responding to significant political changes. “At the end of the day, these are policy instruments,” Navarro stated, noting the potential for swaps to be utilized for energy security. He has been advocating for a swap model that channels savings into U.S. oil and gas imports, alongside financing liquefied natural gas plants in emerging markets.

The role of the US International Development Finance Corporation (DFC) is increasingly vital in this evolving market. The DFC has provided political risk insurance for over half of the completed debt swap transactions, enhancing their attractiveness to private investors. The agency is also likely to assist Citigroup in its reconstruction efforts in Ukraine, which includes managing agreements that facilitate U.S. access to investment projects focused on developing Ukraine’s natural resources.

Understanding how debt swaps function is crucial. Typically, these deals target developing nations aiming to alleviate their debt burden in exchange for commitments to sustainable development goals. They involve repurchasing old debt, often at a discount, funded by new bonds or loans. Multilateral development banks frequently participate, providing risk mitigation through guarantees that reduce the financial risk for investors and help lower borrowing costs for nations.

Despite their potential, debt swaps have faced criticism regarding the standardization of reporting for fees and savings. Investors often prioritize the environmental or social impact of their investments. Marine de Bazelaire, former head of sustainability at HSBC Holdings Plc, cautions that borrowing nations must remain vigilant against ceding control of domestic priorities to foreign entities, emphasizing the implications for national sovereignty.

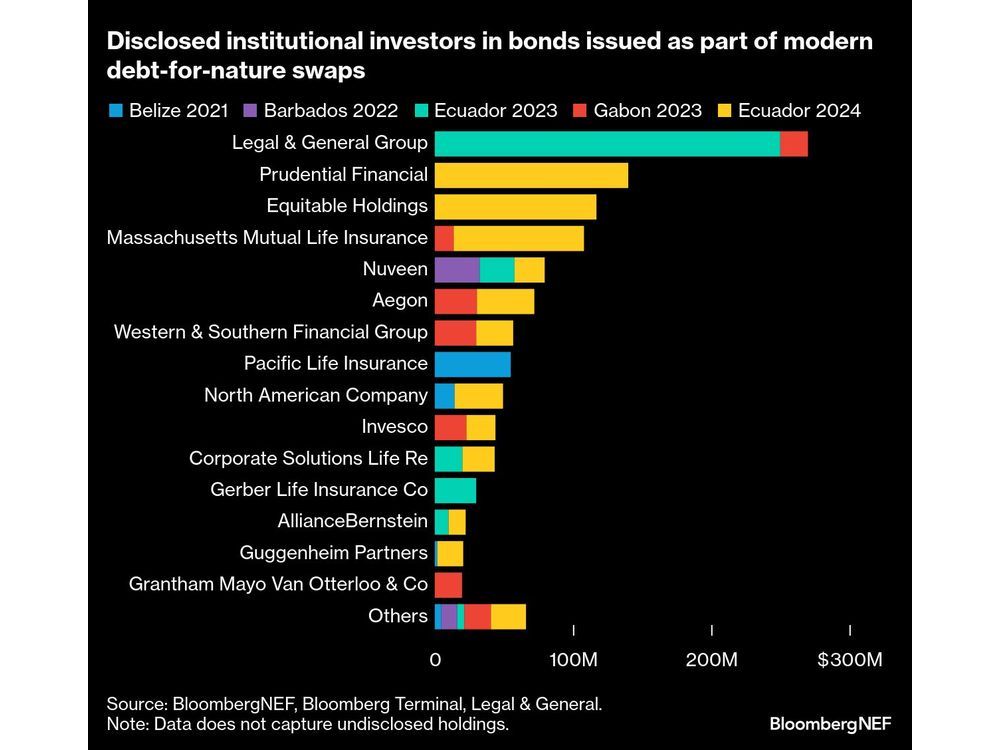

The commercial debt swap market, which has been operational in its current form since 2021, more than doubled in size last year, reaching approximately $4.7 billion. There is potential for these financial instruments to unlock up to $100 billion specifically for climate-related initiatives, as highlighted by various nonprofit organizations advocating for developing countries.

Harper from Legal & General, which has invested close to $500 million in debt-for-nature swaps, indicates that upcoming deals will focus on the United Nations Sustainable Development Goals beyond nature conservation, including affordable energy and poverty alleviation. Ilan Goldfajn, president of the Inter-American Development Bank, notes a growing demand for debt swap structures that target education and health sectors.

The financial profile of debt swaps is particularly advantageous for environmental projects, according to Ramzi Issa, co-founder of Enosis Capital. He emphasizes that these instruments offer long-term, stable cash flows essential for preserving natural ecosystems, contrasting them with traditional infrastructure financing. “Financing infrastructure has been around for a long time, whereas on the development side, having this constant stream of available investment in the project aligns very well,” Issa explained.

As the market for debt swaps continues to expand, the adaptation of these financial tools to new sectors could prove complex and time-consuming. Daniel Ballesta, executive director at Enosis, notes that adapting different sectors to the debt swap model requires a substantial investment of time and resources. “You also have to adapt that different sector to the debt swap model,” he said.

Looking ahead, Harper at Legal & General believes there are no significant limits to the sectors or purposes to which debt swaps can be applied, provided they address areas that are structurally underfunded. The evolving landscape of debt swaps reflects a dynamic financial strategy that responds to immediate needs while striving for broader sustainable development objectives.

-

Science2 months ago

Science2 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health2 months ago

Health2 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories2 months ago

Top Stories2 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology2 months ago

Technology2 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World2 months ago

World2 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Technology2 months ago

Technology2 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology2 months ago

Technology2 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology2 months ago

Technology2 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology2 months ago

Technology2 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business2 months ago

Business2 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Lifestyle2 months ago

Lifestyle2 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology2 months ago

Technology2 months agoApple Expands Self-Service Repair Program to Canada