Business

Gold and Silver Prices Surge as Market Anticipates Rate Cuts

Gold prices have remained robust, trading just below record highs, while silver has surged above $40 an ounce. This upward momentum reflects expectations of potential interest rate cuts by the Federal Reserve and increasing demand for precious metals amid growing geopolitical and economic uncertainties.

Spot silver experienced a significant rally, climbing as much as 2.7% on Monday before reaching levels not seen since 2011. Gold, meanwhile, held a 0.8% gain, trading close to its April record of above $3,500 an ounce. The current market dynamics highlight a renewed interest in precious metals as safe-haven assets.

Market Dynamics Driven by Federal Reserve Speculation

The recent surge in precious metals is largely attributed to expectations that the Federal Reserve will lower interest rates this month. Fed Chair Jerome Powell has indicated a cautious openness to rate reductions, which, if confirmed, could further enhance the appeal of gold and silver, both of which do not yield interest. The upcoming US jobs report, scheduled for release on July 7, 2023, is expected to provide additional insight into the labor market’s status and could bolster arguments for rate cuts.

Analysts from BMO Capital Markets, including Helen Amos and George Heppel, note that technical resistance levels have been breached, suggesting that gold may reach new all-time highs this week. They anticipate continued net inflows into gold-backed exchange-traded funds (ETFs), driven by a growing appetite for these precious metals.

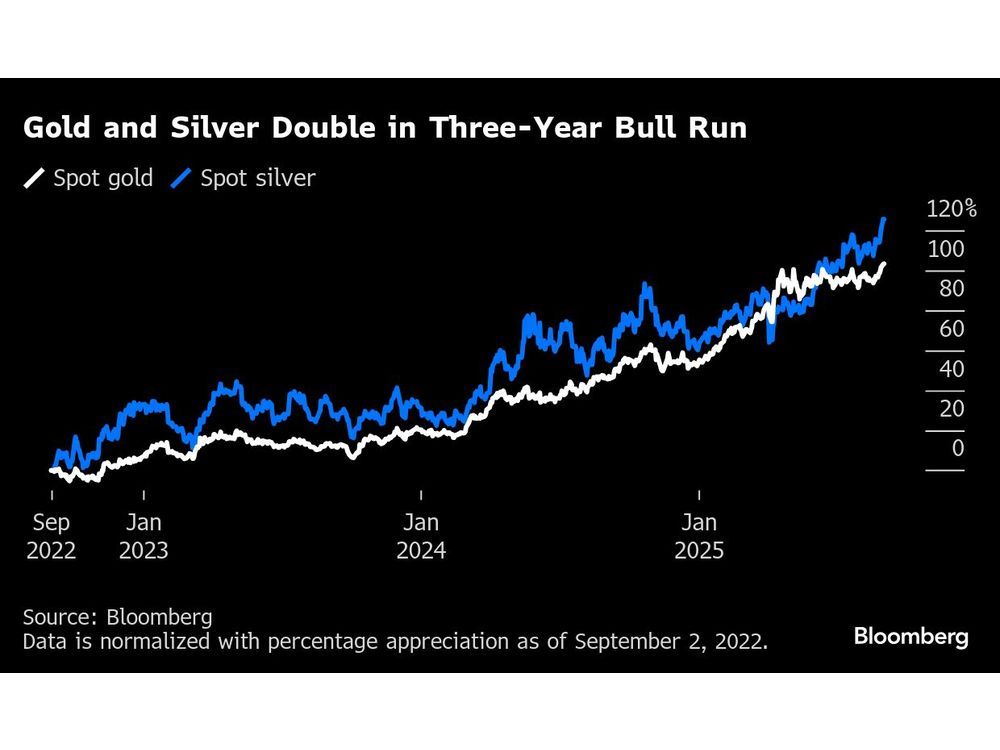

Both gold and silver have more than doubled in value over the past three years, fueled by escalating risks in geopolitical matters, economic stability, and global trade. Recent tensions surrounding Donald Trump’s critiques of the Federal Reserve have heightened investor fears regarding the central bank’s independence, which may be affecting market confidence.

Silver’s Industrial Demand and Supply Deficits

Silver has experienced remarkable growth this year, rising over 40%, outpacing gold’s gains. The metal’s industrial applications, particularly in clean-energy technologies like solar panels, contribute to its increasing demand. According to the Silver Institute, the market is heading toward a fifth consecutive year of supply deficits, further tightening availability.

A weaker US dollar has also enhanced purchasing power for major consumers such as China and India. In August, silver ETF holdings expanded for the seventh month in a row, diminishing the stockpile of freely available metal in London. As a result, lease rates for borrowing silver remain elevated at approximately 2%, significantly higher than the typical near-zero levels.

Investor interest in precious metals has been further buoyed by the potential for US tariffs on these commodities. Silver was recently added to a list of critical minerals by the US government, which already includes palladium, intensifying market focus.

As of 7:43 a.m. in Singapore, spot gold traded at $3,479.38 an ounce, slightly up by 0.1%, while silver was down marginally to $40.67 an ounce. The London Bullion Market Association auction reported a new all-time high for gold at $3,474.90 an ounce on Monday. These developments underscore the ongoing volatility and dynamic nature of the precious metals market, driven by a complex interplay of economic factors and investor sentiment.

-

Science2 months ago

Science2 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health2 months ago

Health2 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories2 months ago

Top Stories2 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology2 months ago

Technology2 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World2 months ago

World2 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Technology2 months ago

Technology2 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology2 months ago

Technology2 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology2 months ago

Technology2 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology2 months ago

Technology2 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business2 months ago

Business2 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Lifestyle2 months ago

Lifestyle2 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology2 months ago

Technology2 months agoApple Expands Self-Service Repair Program to Canada