Business

US Corporate Bond Sales Reach Record Levels Amid Falling Costs

Companies across various sectors are seizing the opportunity presented by declining borrowing costs, propelling US corporate-bond sales to unprecedented levels this month. Notably, Oracle Corp. completed an impressive $18 billion bond issuance on Wednesday, contributing to an overall investment-grade issuance that has surpassed $190 billion in September. This marks just the seventh time in history that such a milestone has been achieved in this month, according to data compiled by Bloomberg.

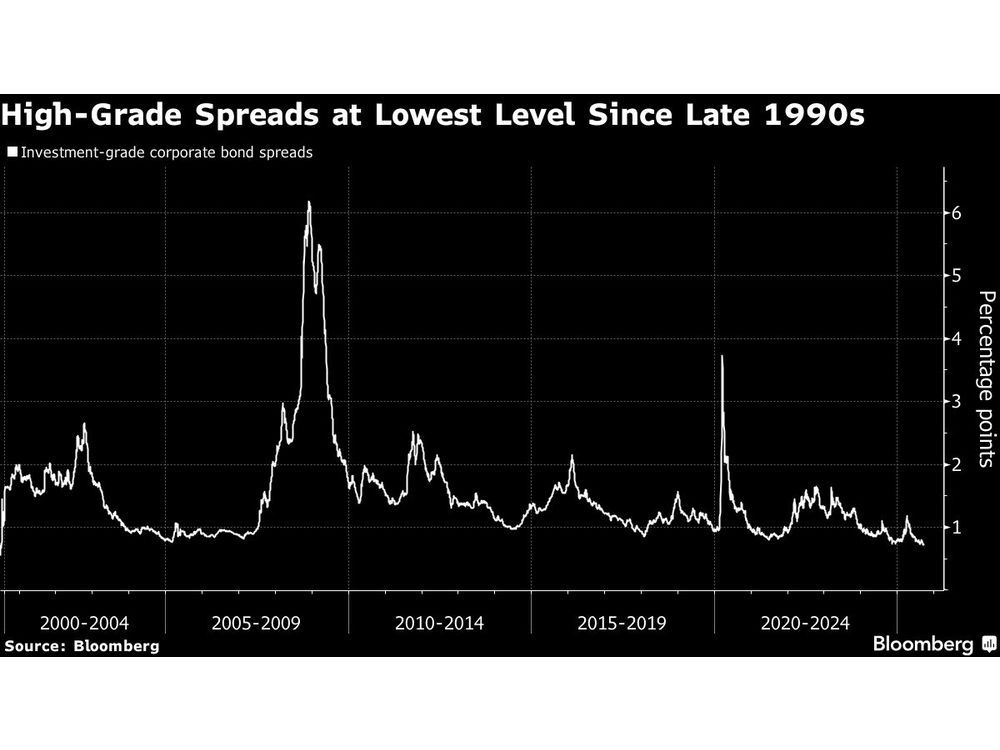

In addition to investment-grade bonds, junk-bond sales are also on track to reach their highest monthly total since September 2021, projected to hit $43 billion by the end of the day, with $7.95 billion of notes expected to price shortly. The high-grade market set a September issuance record on Tuesday, a month that is traditionally one of the busiest for corporate bond offerings. Last week, average spreads reached their tightest level in nearly three decades, further stimulating market activity.

Mark Clegg, a senior fixed income trader at Allspring Global Investments, emphasized the favorable timing for investment-grade borrowers, stating, “New issue concessions are absent with massive order books for every deal.” Concessions refer to the premiums companies typically offer investors, which have recently been lower than levels seen earlier in 2024. Oracle’s bond sale attracted peak demand of approximately $88 billion, making it the second-largest investment-grade deal this year.

The landscape for junk bonds has also improved, with yields dropping to their lowest levels since April 2022, coinciding with the beginning of Federal Reserve interest rate hikes. Since June, issuance of high-yield notes has surged as borrowing costs have decreased. Among the notable deals on Wednesday was a $3.65 billion offering from power producer NRG Energy Inc.

As many junk bonds issued in 2022 and 2023 become callable, the current market conditions present an advantageous opportunity for companies to refinance their existing debt. According to Bloomberg Intelligence analyst Noel Hebert, firms are motivated to secure financing before the onset of quarterly earnings reports and potential market slowdowns in the fourth quarter.

Corporate bond sales have remained robust throughout September, particularly following the Federal Reserve’s decision to cut its policy rate by a quarter-point last week, along with indications of two more rate reductions anticipated later this year. With firms eager to lock in attractive funding levels, the momentum in the corporate bond market is expected to continue as companies navigate their financing needs in a dynamic economic environment.

-

Science2 months ago

Science2 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health2 months ago

Health2 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories2 months ago

Top Stories2 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology2 months ago

Technology2 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World2 months ago

World2 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Technology2 months ago

Technology2 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology2 months ago

Technology2 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology2 months ago

Technology2 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology2 months ago

Technology2 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business2 months ago

Business2 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Lifestyle2 months ago

Lifestyle2 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology2 months ago

Technology2 months agoApple Expands Self-Service Repair Program to Canada