Business

Elliott Investment Management Recommended as Citgo Buyer for $5.89 Billion

An affiliate of Elliott Investment Management has been recommended as the winning bidder in a court-ordered auction for Citgo Petroleum Corp.’s parent company, PDV Holding, with a bid of $5.89 billion. This proposal includes settling outstanding debts owed to bondholders who have claims on the asset. The recommendation follows a competitive legal dispute involving Gold Reserve Ltd., a Venezuelan creditor that is pursuing claims for the expropriation of its mining assets.

The legal proceedings reached a critical juncture on September 15, 2023, during a court session in Delaware. The court-appointed special master, Robert B. Pincus, indicated that Gold Reserve’s recent offer did not surpass the bid presented by Amber Energy Inc., Elliott’s affiliate. Pincus stated in a court filing, “The Amber Sale Transaction continues to constitute a Superior Proposal, providing adequate value to holders of Attached Judgments under Delaware law.”

Gold Reserve responded to the special master’s recommendation by asserting its intention to contest it vigorously, claiming its bid totals $7.9 billion and aims to exclude bondholders from the deal.

The ongoing legal battle centers around Venezuelan creditors who collectively seek over $20 billion in claims related to unpaid debts and expropriations. Pincus’s recommendation emphasizes the relative certainty of closing the deal presented by Elliott, which he noted “virtually eliminates any closing risks” associated with potential litigation from bondholders.

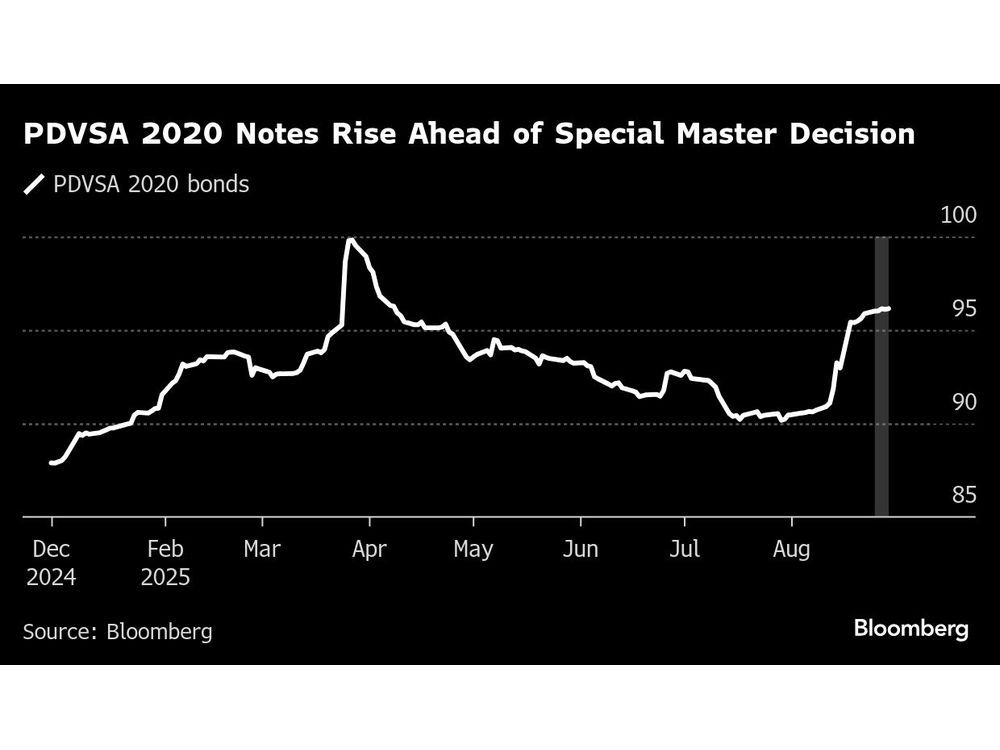

The bondholders in question are linked to Petroleos de Venezuela SA, Venezuela’s state-owned oil company, which defaulted on its bonds in 2020. These bonds were secured by a controlling stake in Citgo Holding, a subsidiary of PDV Holding. The validity of this debt is currently under scrutiny in a New York court, with a ruling expected shortly. Regardless of the outcome, Elliott’s offer includes a $2.1 billion settlement for the notes, which Pincus identified as representing an $895 million discount on the total claims.

Gold Reserve has proposed an alternative deal with bondholders, yet Pincus expressed “material reservations” regarding the viability of this plan, pointing out uncertainties around its financing. He warned the court that reliance on Gold Reserve’s offer could lead to complications, including the potential need for a new bidding process at significantly reduced levels.

In light of these factors, Pincus concluded that the Amber bid, which would clear $5.892 billion of judgments against PDV Holding, represents the best option for all parties involved.

The ongoing case is formally titled Cyrstallex International Corp. v. Bolivarian Republic of Venezuela, filed in the U.S. District Court for the District of Delaware. The upcoming sale hearing is expected to significantly impact the financial futures of all stakeholders involved, underscoring the intricate interplay of international finance and legal adjudication.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19