Business

Euro-Zone Inflation Surges to 2.1%, Supporting ECB Rate Stability

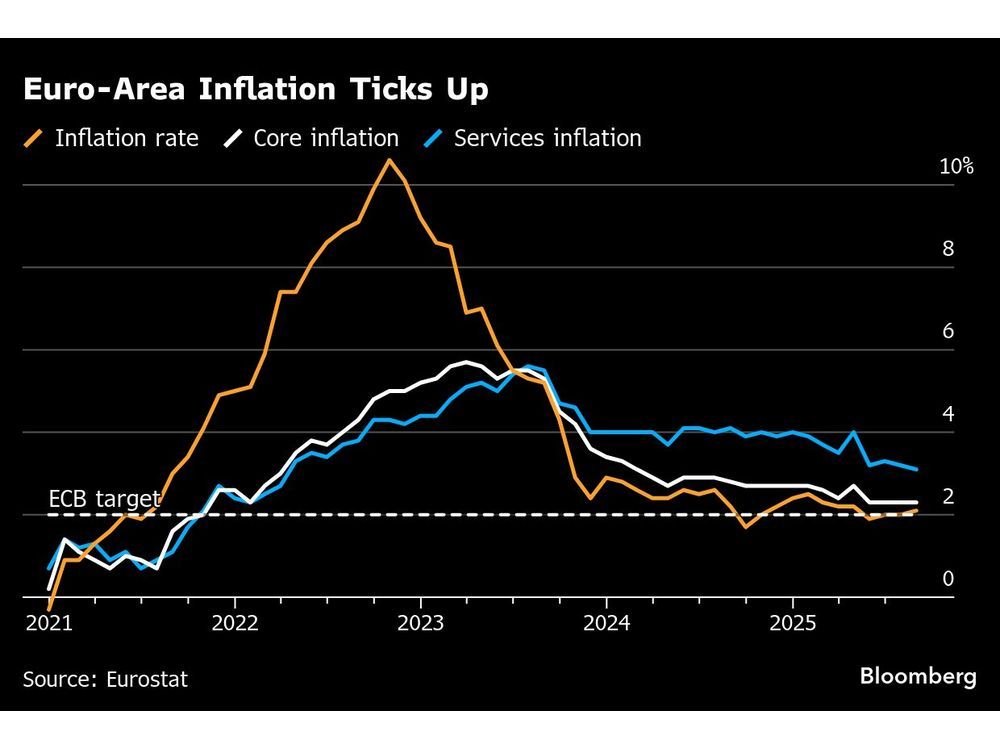

Inflation in the euro area has risen beyond the European Central Bank’s (ECB) target, prompting expectations that officials will maintain interest rates during their upcoming meeting. In August 2023, consumer prices increased by 2.1% compared to the previous year, up from 2% in July. This rise aligns with economists’ forecasts in a Bloomberg poll, suggesting a steady position for the ECB.

The core inflation measure, which excludes volatile items such as energy and food, remained unchanged at 2.3%. Notably, the price increases in the services sector moderated to 3.1%. This data supports the ECB’s stance that it can pause any further interest rate cuts during its meeting scheduled for September 11, 2023.

Central Bank Perspectives on Economic Conditions

In July, the ECB had already kept the deposit rate at 2%, with President Christine Lagarde stating that the central bank is in a “good place.” Following the latest inflation figures, investor confidence has shifted, with many now doubting that additional rate cuts will occur this year. Economist Josie Anderson from Nomura expressed optimism, asserting, “We think the broad picture for inflation is that it will stay steady at around that 2% mark for the rest of the year.” She further indicated that no rate cuts are anticipated.

Officials at the ECB have emphasized that the criteria for further reductions in rates are stringent. Bundesbank President Joachim Nagel described the economy as being in a “kind of equilibrium,” with both inflation and rates at 2%. Conversely, hawkish Executive Board member Isabel Schnabel has voiced her opposition to further rate cuts, citing that tariffs could be “on net inflationary.”

Mixed Economic Indicators and Future Projections

A differing perspective emerged from Gediminas Simkus, the head of Lithuania’s central bank, who suggested that a reduction in borrowing costs is more likely than not, particularly with the December meeting on the horizon. This viewpoint underscores the ongoing debate among policymakers regarding the economic trajectory.

The latest inflation data highlights a mixed bag of economic reports across the eurozone. While inflation in France, Italy, and Spain fell short of expectations, Germany’s figures slightly exceeded forecasts. The overall economic outlook remains uncertain, even as the European Union reached an agreement with the United States to fix most tariffs on exports to 15%.

Warnings regarding inflation risks were also issued by Olli Rehn, a member of the Governing Council, who noted potential “downside risks” stemming from a stronger euro, lower energy costs, and a decrease in core inflation. Insights from the ECB’s July meeting revealed a divergence of views among policymakers, with some expressing concerns about inflationary pressures due to economic resilience, while others assessed the risks to the price outlook as balanced.

The evolving economic landscape in the eurozone will remain under scrutiny as the ECB prepares for its next meeting. The interplay of inflation and interest rates will be pivotal in shaping the region’s economic policies in the coming months.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19