Business

Hong Kong Investment Corp. Embraces Global Geopolitical Risks

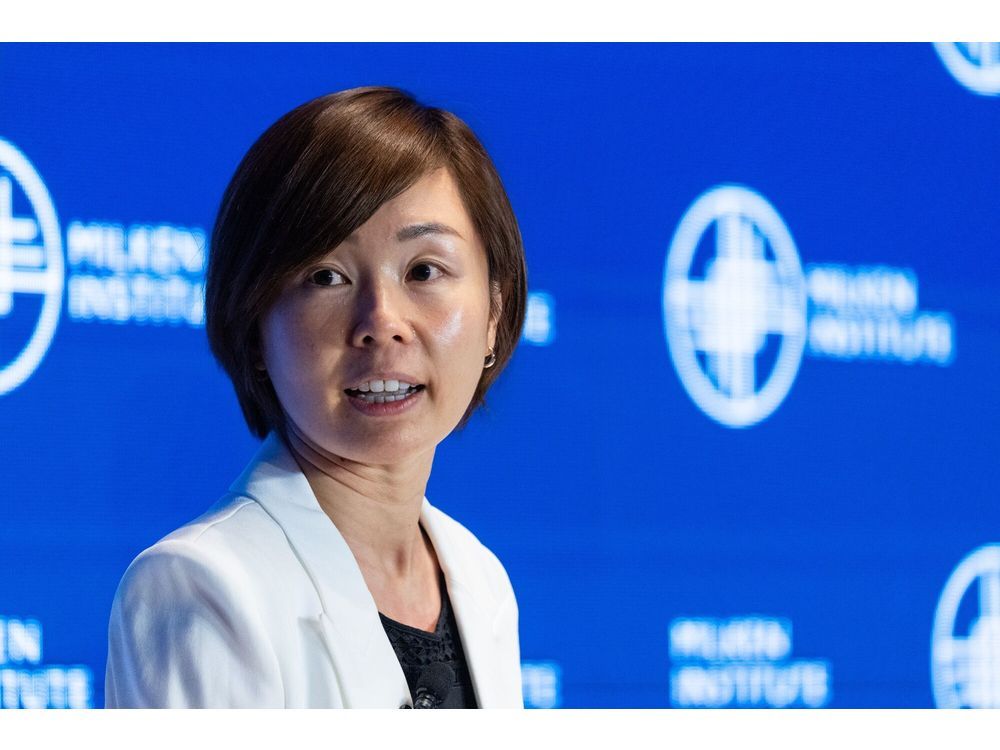

Hong Kong Investment Corp. (HKIC), a fund established by the local government, is committed to navigating global geopolitical challenges in its investment strategy. In a recent interview with Bloomberg Television, CEO Clara Chan emphasized that geopolitical factors, while significant, are viewed as inherent challenges rather than deterrents.

Chan stated, “Geopolitics, like other risks, they are like a given for our underwriting right now. But the power of ‘patient capital’ is that we can transcend cycles.” This perspective underscores the fund’s commitment to long-term investment strategies, positioning itself to take advantage of market fluctuations.

Strategic Investment Focus

Since its inception in 2022 with a capital base of HK$62 billion (approximately $8 billion), HKIC has prioritized investments that drive economic growth in Hong Kong and strengthen ties with surrounding mainland Chinese cities. Chan articulated the fund’s objective to foster innovation and technology as pivotal areas for investment.

To date, HKIC has invested in over 120 projects, targeting sectors such as artificial intelligence, biotechnology, and new energy. Notable enterprises in its portfolio include Phase Scientific International Ltd., EcoCeres Ltd., and Beijing Galbot Co.. With two portfolio companies already listed on the Hong Kong Stock Exchange, more than ten others are preparing for initial public offerings (IPOs) in the city this year.

Chan highlighted the importance of early and strategic investments, stating, “Picking the right themes and investing early are critical to navigate the challenge.” She believes that the current market environment, filled with “noises and rumors,” may present valuable opportunities for the fund.

Global Outreach and Collaboration

Looking beyond Hong Kong and mainland China, HKIC is also exploring investment opportunities in international markets. Chan noted, “We definitely need to cast the net as wide as possible. We have to attract the smartest minds from around the world as companies to come and develop in Hong Kong.”

The fund is actively facilitating connections between its portfolio companies and other sovereign wealth funds and corporate investors, particularly those in Belt and Road Initiative countries and Southeast Asia. This collaborative approach aims to bolster the global presence of Hong Kong’s economy.

Chan addressed the dynamics of investment exits, clarifying that a company’s listing does not automatically equate to HKIC cashing out. “The Hong Kong stock market is great, I’m sure it will continue with its great momentum,” she said. “The expiry of a lockup period does not necessarily mean an automatic exit of the company.”

Through its strategic investments and international outreach, Hong Kong Investment Corp. is positioning itself as a pivotal player in the region’s economic landscape, ready to embrace both challenges and opportunities in the evolving global market.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19