Business

Meta Anticipates Strong Q3 2025 Earnings Amid AI Focus

Investors are keenly awaiting the upcoming Q3 2025 earnings report from Meta Platforms Inc. (NASDAQ:META), with market expectations indicating a robust performance. Analysts have raised their forecasts significantly, reflecting confidence in the company’s advertising revenue growth and investment in artificial intelligence technologies.

The anticipated earnings report is particularly critical as Meta’s advertising revenue remains a central pillar of its financial health. Analysts tracked by FactSet expect this revenue to reach approximately $48.5 billion, representing a 21.6% increase compared to the same period last year. This growth rate closely mirrors the previous quarter’s performance, indicating consistent demand for Meta’s advertising services.

AI Investments Shape Market Sentiment

Artificial intelligence has become a focal point in the tech industry, with companies striving to invest heavily to maintain competitiveness. Meta is no exception, having announced an initial investment of $66–72 billion in AI, which could potentially rise to $100 billion by 2026. Investors are closely monitoring these expenditures in quarterly reports, as they signal the company’s commitment to future readiness.

Despite the optimism, concerns linger regarding rising costs and potential losses associated with Meta’s ResearchLab, which spearheads its generative AI initiatives. Additionally, expenditures on virtual reality (VR) projects and gaming continue to draw scrutiny. The balance between investment in innovation and overall profitability will be pivotal for the upcoming results.

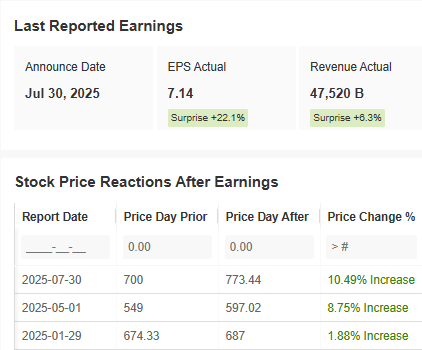

Market reactions to past earnings reports have generally been positive, with each announcement this year resulting in stock price increases. The current trading range for Meta’s shares hovers between $690 and $790. Should the company meet or exceed analyst expectations in its upcoming report, it could push past the $800 mark, setting new record highs.

Technical Outlook and Market Predictions

After experiencing a brief pullback, Meta’s stock is trending upward, indicating renewed investor confidence. If the company’s Q3 results align with the optimistic forecasts, analysts predict that the stock could break through its existing resistance levels. Conversely, a decline below $690 could signal potential weaknesses, with support levels identified at $660 and $630.

As the market prepares for the earnings announcement, the focus remains on Meta’s ability to sustain its momentum amidst significant investments in AI. The outcome of this report will not only influence Meta’s stock trajectory but could also set the tone for investor sentiment in the tech sector at large.

As a reminder, this article is intended for informational purposes only and does not constitute financial advice or a solicitation to invest. Investors are encouraged to conduct thorough research and consider the risks involved in any financial decisions.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19