Science

Investors Flock to Nuclear Stocks Amid AI Power Demand Surge

Investors are increasingly turning their attention to nuclear energy stocks, driven by a surge in demand for electricity powered by artificial intelligence (AI). Despite having no revenue or operational power plants, Nano Nuclear Energy Inc. has seen its valuation exceed $2.3 billion. This market enthusiasm appears to be more rooted in speculation than concrete fundamentals, as investors anticipate that tech giants will require vast new energy sources to support their expanding data centers.

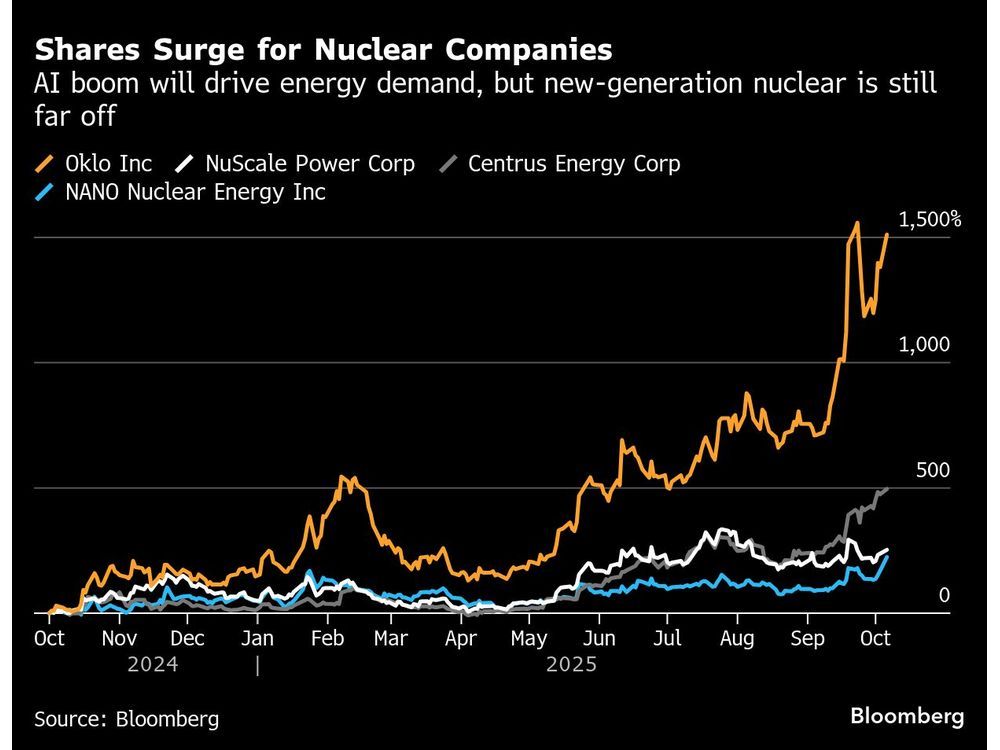

The interest in nuclear energy extends beyond Nano Nuclear. Shares of Oklo Inc., backed by OpenAI‘s Sam Altman, have skyrocketed by more than 1,000% in the past year. Other companies, including NuScale Power Corp. and Centrus Energy Corp., have also experienced significant increases in their stock prices, with NuScale and Nano Nuclear both tripling in value, while Centrus has seen its shares rise by over 400%.

Despite this optimism, seasoned analysts caution that such exuberance may be premature. Dimple Gosai of Bank of America recently downgraded both Oklo and NuScale, suggesting that their current valuations are “running ahead of reality.” Long lead times, persistent regulatory challenges, and an uncertain fuel supply could delay commercial nuclear projects until well into the next decade, with widespread deployment not expected before 2035 and mainstream adoption around 2040.

The demand for electricity from data centers is compelling, yet significant obstacles remain. Paul Zimbardo, an analyst at Jefferies, highlighted that tech companies require immediate power solutions, not the delayed offerings from new nuclear projects. He noted, “The hyperscalers are willing to pay almost any price for power in the near term. But that’s not what new nuclear offers.”

Nuclear power has long been a staple of the energy grid, but emerging companies are shifting their approach. They are developing small modular reactors (SMRs), which can be manufactured in factories and assembled on-site, aiming to reduce costs and construction times. However, this strategy remains largely untested, with only a few such reactors built primarily in China and Russia. The U.S. is still years away from operational SMRs, yet investors are betting on their potential to meet rising clean energy demands.

The energy landscape is changing, with data centers projected to account for 7% of the United States’ electricity demand by the end of the decade, up from approximately 4% currently, according to BloombergNEF. A similar narrative is unfolding in the hydrogen sector, where rising electricity prices and AI’s energy needs have bolstered share prices for struggling companies. For instance, shares of fuel-cell company Bloom Energy Corp. have increased, while Plug Power Inc., a hydrogen supplier, surged by about 70%.

Last month, Oklo broke ground on its first commercial system in Idaho, aiming for operational status by 2028, although it still requires approval from the NRC before construction can progress. The company plans to utilize a new type of uranium fuel known as HALEU, which is not yet widely accessible, posing additional challenges to Oklo’s timeline. Despite these hurdles, Oklo has been selected for two significant U.S. Energy Department programs designed to accelerate the deployment of advanced nuclear plants and ensure a supply of necessary fuel.

In contrast, NuScale remains the only small-modular-reactor developer with an NRC-approved design. However, it faced setbacks when its first U.S. project was canceled last year due to escalating costs. Nano Nuclear has yet to announce a construction start date or submit a license application to the NRC, and none of these companies have reported profits thus far.

Centrus Energy, which is already profitable, is also being valued like a startup, trading at approximately 67 times earnings. This valuation is more typical of Silicon Valley than the power sector, as investors speculate that its early production of HALEU fuel will eventually cater to the emerging SMR industry.

Dan Leistikow, Vice President of Centrus Energy, noted that the demand for clean power is reshaping investor perceptions of nuclear energy. “Nuclear was, for many years, an undervalued and underappreciated asset,” he remarked. “That’s beginning to change now as we face surging demand for electricity and huge new power requirements for AI and data centers.”

While a spokesperson from Nano Nuclear was unavailable for comment, NuScale declined to provide a statement. Energy investor Rob Thummel, senior portfolio manager at Tortoise Capital, has been actively monitoring the nuclear sector. His firm recently filed to launch a nuclear-focused exchange-traded fund, reflecting a growing interest in this area. Currently, Thummel favors established reactor operators like Constellation Energy Corp. and Vistra Corp., but he remains optimistic about nuclear energy’s long-term potential as data centers continue to drive demand for carbon-free electricity. “They’ve got some work ahead of them,” he cautioned. “But if you think about what they could do, it’s pretty remarkable.”

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey