Top Stories

Apollo Global Management Sees Bright Future for Europe Investment

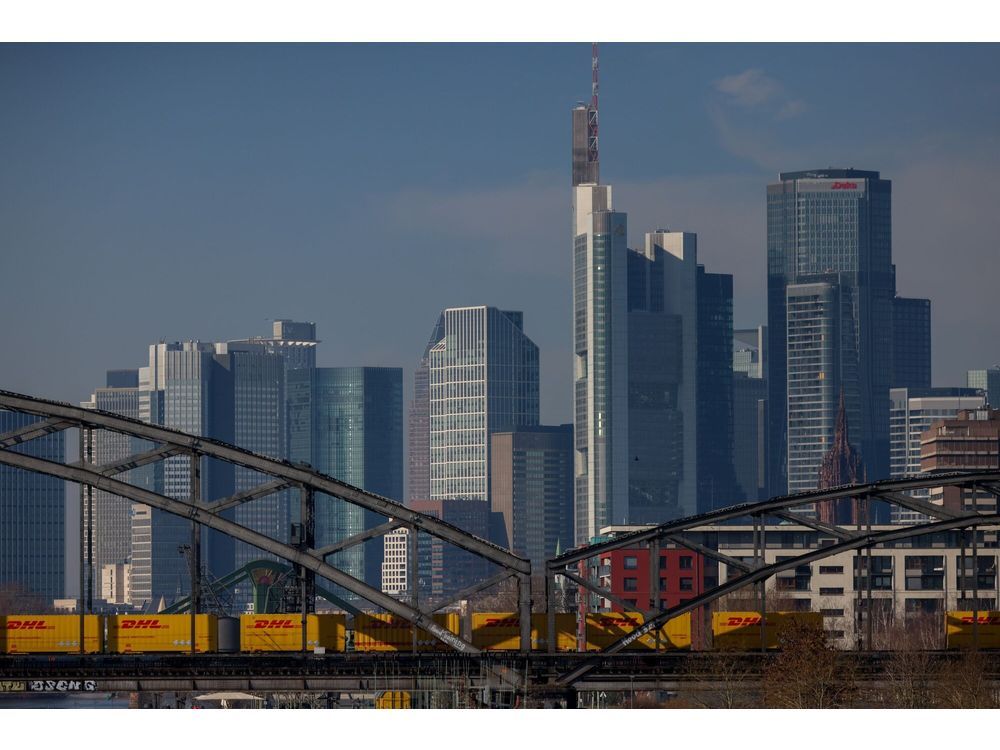

Apollo Global Management Inc. has expressed an unprecedented level of optimism regarding investment opportunities in Europe, marking a significant shift in its strategy after two decades of operations on the continent. According to Robert Seminara, the head of Apollo in Europe, the sentiment is driven by a growing recognition among European governments of the need to engage with private capital to stimulate economic growth.

Speaking at Bloomberg’s Future of Finance conference in Frankfurt on March 12, 2024, Seminara stated, “I think Europe has woken up on the need to invest.” He highlighted the proactive stance of the German government in particular, noting an encouraging attitude that extends beyond mere financial commitments. “It’s not just the dollars – it’s the attitude, it’s the willingness to kind of help private capital really advance in the market,” he added.

Investment Priorities and Growth Areas

Seminara identified several key areas driving investment in Europe, including defense spending, infrastructure development, and the transition to green energy. He emphasized that Europe’s relatively shallow capital markets compared to the United States present significant opportunities for major investment firms to step in and provide necessary financing.

Apollo has already approached €50 billion in investments across Europe, with notable transactions including a €3.2 billion (approximately $3.8 billion) investment in collaboration with RWE AG to finance the expansion of Germany’s power grid. Additionally, the firm has committed to supporting Electricite de France SA in the construction of the Hinkley Point C nuclear power plant and other related projects.

To further capitalize on these opportunities, Apollo is planning to expand its presence in Europe, with Seminara indicating that a new office will open shortly in Frankfurt. The firm has recently established a site in Zurich and maintains its principal European headquarters in London.

A Strategic Focus Amid Market Trends

While acknowledging the surge in interest surrounding artificial intelligence and defense sectors, Seminara noted that Apollo is strategically avoiding these areas. The firm prefers to focus on companies that provide essential services within these sectors, such as its recent acquisition of Kelvion, a company specializing in cooling equipment. This acquisition, made after Kelvion’s challenging debt restructuring in 2019, positions Apollo favorably in a niche market that supports data center cooling solutions.

Seminara remarked on the broader implications of this investment strategy, stating, “I think Europe for a long time has been kind of on the back burner in terms of investors’ mindset, and it’s really up to Germans, Europeans more broadly to really seize the moment.” He believes that if Europe can harness these investment opportunities effectively, it could lead to significant economic growth, addressing many of the pressing challenges currently faced across the continent.

The commitment from Apollo Global Management to invest heavily in Europe signals a pivotal moment for the region, suggesting a potential shift in the investment landscape that could have lasting impacts on its economic future.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19