Top Stories

Campbell River Business Owner Loses $82,000 to Bank Spoofing Scam

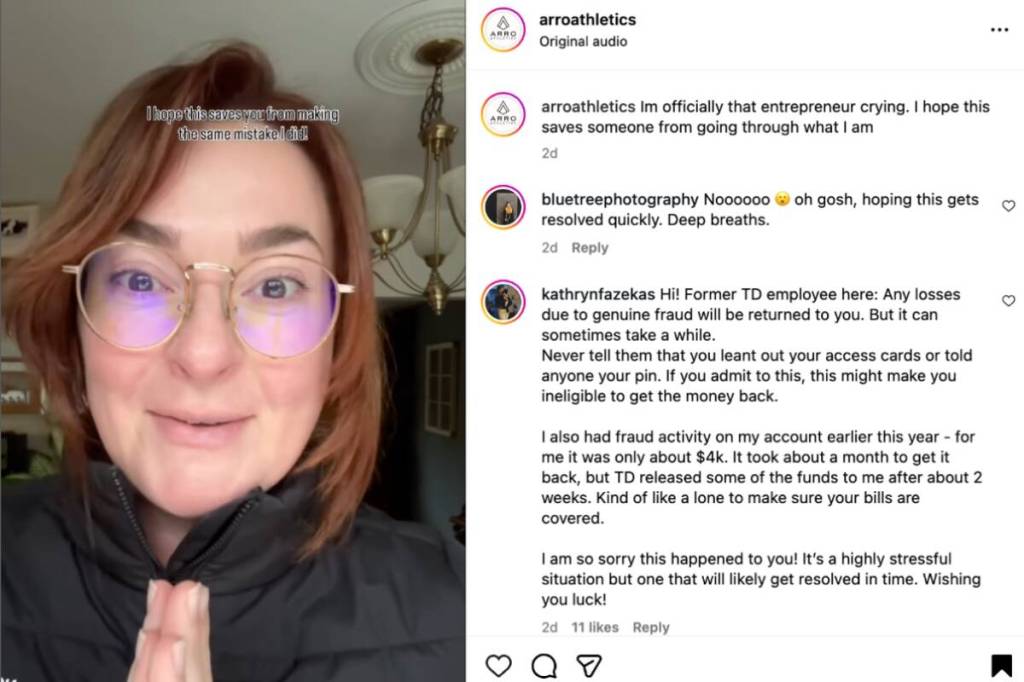

A business owner in Campbell River has fallen victim to a sophisticated scam, losing $82,000 to fraudsters impersonating her bank. Farro Mackenzie, the owner of Arro Athletics, reported that the incident began with a deceptive text message regarding payment attempts on her credit card.

Mackenzie responded to inquiries about charges, unknowingly engaging with the scammers. She recounted, “From there, somehow they’d gotten into my business chequing account and created a $53,000 payment to a company called Silver Gold and a $29,000 payment to Scotia line of credit.” It wasn’t until the scammers attempted to withdraw an additional $20,000 that Mackenzie received a legitimate call from someone she believed to be from TD Bank.

“I was like, ‘That payment’s not me,’” Mackenzie said. “They were like, ‘Good, we caught it.’” After assuming the situation had been resolved, she discovered days later that she had been deceived when she visited a TD branch to pay for her store’s inventory.

Uncertain of how the scammers accessed her chequing account, Mackenzie noted that she had not disclosed sensitive information but merely confirmed whether certain charges on her credit card were legitimate. In a social media post, she cautioned others about the dangers of such scams. “They can hijack the phone number and caller ID. This is my warning to you. Do not trust any calls. Do not answer those calls. Hang up and call yourself on the number on the back of your card.”

This type of fraud, known as spoofing, involves cybercriminals disguising their communications to appear as if they originate from a trusted source. According to Get Cyber Safe, a Government of Canada initiative, “Cyber criminals use spoofing to fool victims into giving up sensitive information or money or downloading malware.”

Mick Ramos, senior manager with TD Bank, expressed concern for Mackenzie’s situation, stating it is “distressing to be a victim of fraud.” While unable to discuss specific details due to client privacy, Ramos confirmed the bank is investigating the matter and has reached out to Mackenzie. He advised individuals to hang up if they receive calls from someone claiming to be from their bank’s fraud department, and to use the number on the back of their debit card to verify any communications.

Scammers can utilize call spoofing technology to make calls appear as if they are from legitimate institutions. As of September 30, 2025, there have been 33,854 reported cases of fraud in Canada, affecting 23,113 victims and resulting in losses totaling $544 million, according to the Canadian Anti-Fraud Centre.

Individuals who suspect they have fallen victim to a scam are urged to report it immediately to their financial institution, credit bureaus, local police, and the Canadian Anti-Fraud Centre to help prevent further incidents.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19