Top Stories

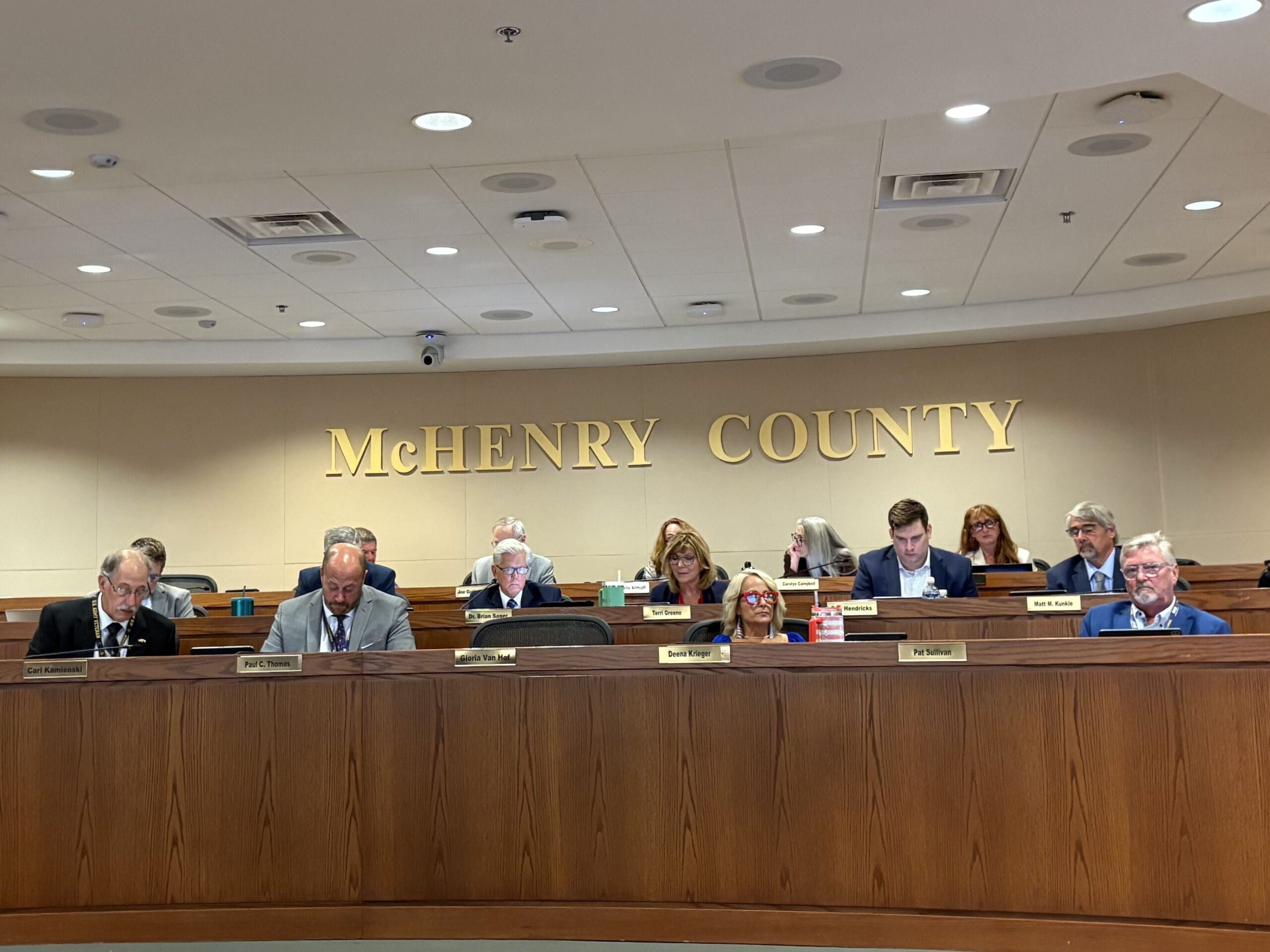

McHenry County Board Approves Property Tax Levy Increase Amid Disputes

The McHenry County Board has voted to raise its property tax levy by the inflation-tied limit allowed under state tax regulations. After multiple rounds of voting on November 13, 2023, the board narrowly approved the increase with a vote of 9-8. The decision enables the county to capture new property growth, but it also comes against a backdrop of divided opinions among board members.

Voting in favor of the tax levy were board members Joe Gottemoller, Terri Greeno, Carl Kamienski, Deena Krieger, Mike Shorten, Larry Smith, Pat Sullivan, Paul Thomas, and Tracie Von Bergen. Those opposing the levy included Carolyn Campbell, John Collins, Eric Hendricks, Jim Kearns, Matt Kunkle, Brian Sager, Michael Skala, and Gloria Van Hof, while board member Pamela Althoff was absent.

The board also considered a controversial “lookback” option that would have allowed for a higher levy by reverting to pre-2024 levels. This option was rejected after failing to secure the necessary votes, despite some members who favored the lookback having previously supported it. Greeno emphasized that the property tax cap law exists for a reason and expressed concerns about the board’s promises to voters regarding tax increases.

Eric Hendricks, a vocal opponent of the levy, described the lookback option as an “absolute betrayal to our voters” and criticized the move as indefensible. The board was under pressure to finalize a decision before the new fiscal year begins on December 1, 2023.

In defending the approved tax increase, Gottemoller explained that the new levy would rise by the Consumer Price Index (CPI), which currently stands at 2.9%, along with capturing new growth. Board Chair Mike Buehler highlighted the county’s ongoing commitment to fiscal stewardship, despite challenges such as unfunded mandates like the SAFE-T Act, which has increased costs for the county by an estimated $1 million annually.

Buehler also noted the significant loss of $18 million in revenue from a previous contract with the federal Immigration and Customs Enforcement agency for housing detainees, which was terminated following a state ban in 2021. He cautioned that while property tax relief is important, it often comes at a cost to the county’s fiscal stability and its ability to provide essential services, including law enforcement.

The discussion surrounding the lookback option saw disagreements among board members, particularly between Collins and Hendricks. Collins argued that the levy vote was about responsibility and maintaining financial stability for the county. He expressed frustration with Hendricks’ comments regarding transparency, stating that not all current members were on the board during the sales tax referendum process.

Kearns, who has traditionally supported stable or reduced levies, expressed concerns that the county’s financial condition would not be sustainable without the lookback. He acknowledged that continued budget cuts would be necessary regardless of the outcome of the lookback vote.

The board’s approved levy for the upcoming fiscal year totals $67.7 million. This decision was made amid discussions of budget constraints, including a gap that was initially estimated at $3.7 million but has since been reduced. County officials assert that the approved budget is balanced, despite the financial pressures faced.

The rejected lookback option would have reverted the property tax levy to a previous fiscal level of $73.8 million prior to a sales tax increase aimed at funding the Mental Health Board. An accompanying proposal for a $4.2 million tax abatement would have mitigated the immediate financial impact on homeowners, but without the lookback, no such abatement is planned.

For context, last year’s levy stood at approximately $65 million, reflecting adjustments made after removing the mental health board funding. As the county prepares for the next budget cycle, officials are mindful that the expiration of COVID-19 relief funds will further strain finances.

The board also approved salary increases for many countywide elected officials in September, which will take effect in fiscal year 2027. Donna Kurtz, the county treasurer, underscored the financial challenges facing the county, urging caution against using fund balances for recurring expenses. She cautioned that such actions could jeopardize investment income and leave the county vulnerable to unexpected costs.

As the board moves forward, officials emphasize that the levy has not kept pace with inflation over the past decade, resulting in significant savings for taxpayers. Since fiscal year 2017, the county has reportedly saved around $128.2 million in taxes, although the ongoing financial landscape remains uncertain. A homeowner with a property valued at $325,000 can expect to pay an additional $20 due to the new levy.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19