Top Stories

UK Household Debt Falls to 23-Year Low, Sparks Consumer Optimism

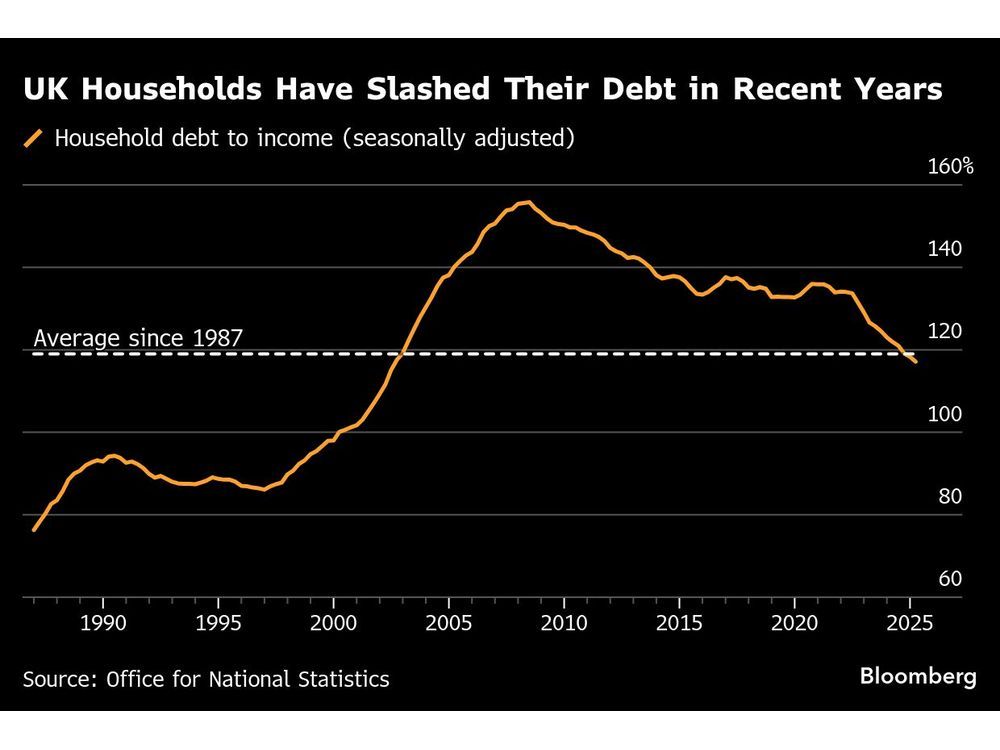

UK household debt has reached its lowest level in 23 years, offering a glimmer of hope for a potential consumer revival. As of the second quarter of 2023, debt as a share of household incomes has dropped to **117.1%**, nearly **40 percentage points** below its peak in **2008**, according to data from the **Office for National Statistics**. This improvement comes after a prolonged period of spending restraint that significantly impacted the British economy.

The question now facing policymakers, including **Chancellor of the Exchequer Rachel Reeves**, is whether consumers will feel confident enough to increase their spending. A notable decline in debt has occurred since the end of **2020**, during which surging inflation and rising interest rates have incentivized saving rather than borrowing.

Potential Impact of Consumer Spending

Consumer spending represents approximately **60%** of the UK’s gross domestic product (GDP), making it a critical factor for economic recovery. James Smith, a developed market economist at **ING**, noted that while household balance sheets are in a favorable position, the overall consumer confidence remains low. “The consumer is an upside risk to growth in the sense that the savings ratio has been very high,” Smith stated.

Britons have adopted a cautious approach to spending, especially compared to their counterparts in the United States. Since the end of **2019**, UK household consumption has only increased by **0.7%**, while the eurozone and the US have seen rises of **3.9%** and **16.4%**, respectively. Consequently, the UK economy is just **5%** larger than it was before the pandemic, in stark contrast to **13%** growth in the US and **8%** in Canada.

Economic analysts from **PwC** suggest that if households were willing to draw from their savings, growth could reach **1.6%** next year, marking a **0.4 percentage point** increase from the baseline scenario. The current state of UK households shows a cautious optimism; despite a reduction in debt to slightly below the long-term average since **1987**, the willingness to spend has not significantly shifted.

Challenges Ahead for the UK Economy

Despite recent improvements in household finances, the cautious attitude among consumers persists. The disposable incomes of UK households have risen by nearly **33%** since **2019**, outpacing the growth in mortgage debt at **16.5%** and consumer credit at **7.4%**, according to **WPI Strategy**. Martin Beck, chief economist at WPI Strategy, remarked, “Prices and wages are rising quite quickly so that’s going to erode the real value” of debt, indicating a complex landscape for consumers.

The **Bank of England** anticipates a recovery in household consumption in the coming years, but it highlights the importance of maintaining a tight monetary policy to bolster consumer confidence. In a recent speech, rate-setter **Catherine Mann** emphasized the need for visible progress in controlling inflation to encourage spending.

As the UK approaches a crucial budget announcement on **November 26**, 2023, consumers and economists alike will be closely watching Reeves’ decisions. If she can avoid repeating the detrimental effects of her previous budget and instead foster optimism about the economic outlook, there is hope that Britons will feel empowered to spend more freely, thereby stimulating the economy.

-

Science3 months ago

Science3 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories3 months ago

Top Stories3 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health3 months ago

Health3 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology3 months ago

Technology3 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World3 months ago

World3 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle3 months ago

Lifestyle3 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology3 months ago

Technology3 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology3 months ago

Technology3 months agoApple Expands Self-Service Repair Program to Canada

-

Technology3 months ago

Technology3 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology3 months ago

Technology3 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Business3 months ago

Business3 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey

-

Technology3 months ago

Technology3 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19