Business

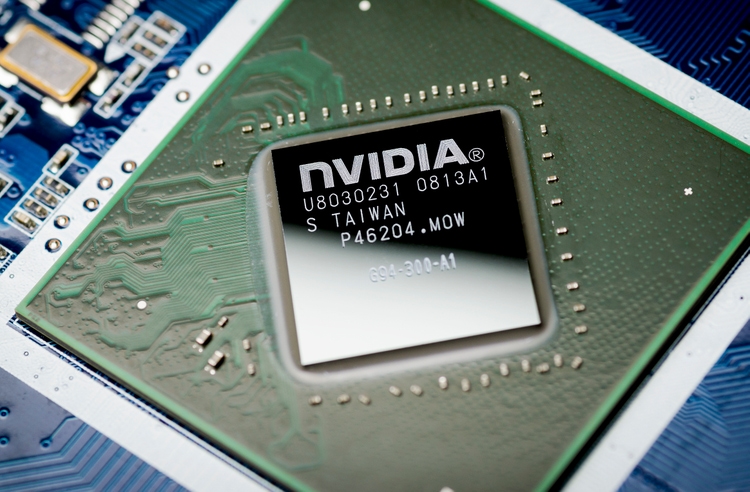

Nvidia Upgraded to Buy After 23% Surge, Faces China Risks

Nvidia (NASDAQ: NVDA) has been upgraded from a strong buy to a buy rating following a significant **23% surge** in its share price. This shift reflects a less appealing entry point for investors looking at the short term. The adjustment comes after Nvidia announced a strategic investment of **$5 billion** in **Intel**, aimed at integrating x86 CPUs with Nvidia GPUs. This move is expected to enhance Nvidia’s data center solutions and provide greater product flexibility.

Market Dynamics and Risks

Despite the recent gains, Nvidia faces mounting risks, particularly in the Chinese market. The increase in export bans and intensified domestic competition raises concerns about future revenue streams from this crucial region. While these challenges have been largely anticipated by investors, they add a layer of complexity to Nvidia’s growth narrative.

Nvidia’s current valuation stands at **31 times** next twelve months price-to-earnings (NTM P/E), which is considered reasonable. However, analysts predict a period of near-term consolidation as the stock digests its recent gains. Investors are now awaiting new earnings catalysts that could further influence the stock’s performance.

In a previous analysis published in June, the share price of Nvidia had remained static for an extended period, prompting a re-evaluation of its market position. This recent surge marks a turning point for the company, as it capitalizes on its strategic investments while navigating the complexities of global market dynamics.

Antonio Bordunovi, an analyst, has emphasized that while Nvidia is well-positioned for growth, investors should remain cautious about short-term fluctuations. The current market environment suggests that while Nvidia has a solid foundation, external factors will play a critical role in shaping its future trajectory.

As of now, Nvidia’s strong market presence and innovative strategies continue to attract attention. Nevertheless, investors should carefully consider the risks involved, particularly given the evolving landscape in China and the competitive pressures that could emerge.

-

Science4 months ago

Science4 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health4 months ago

Health4 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories4 months ago

Top Stories4 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology4 months ago

Technology4 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World4 months ago

World4 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle4 months ago

Lifestyle4 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology4 months ago

Technology4 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology4 months ago

Technology4 months agoApple Expands Self-Service Repair Program to Canada

-

Technology4 months ago

Technology4 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology4 months ago

Technology4 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology4 months ago

Technology4 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business4 months ago

Business4 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey