Business

Inflation Accelerates Across Europe, Impacting Economic Policies

Inflation rates have surged across Europe’s largest economies in September, prompting the European Central Bank (ECB) to maintain its current interest rate strategy. In Germany, consumer prices increased by 2.4% compared to the previous year, marking the fastest annual pace since February. This rise in inflation aligns with similar trends observed in other major economies within the 20-nation euro zone, including France, Italy, and Spain.

Economic Implications and Regional Reactions

The uptick in inflation signals a challenging landscape for the ECB as it evaluates its monetary policy. Increased costs in services are largely responsible for the inflationary pressure felt across the region. Despite these developments, the Swiss economy reported unexpectedly low inflation rates, which presents a dilemma for the Swiss National Bank. This organization has already set interest rates to zero and faces pressure to maintain stability while grappling with the implications of recent US tariffs.

Italy’s government is navigating its fiscal landscape with a newly approved budget that sets a deficit target of 3% of national output for the year. This milestone could potentially allow Italy to exit the European Union’s excessive deficit procedure, a monitoring system that scrutinizes countries with significant fiscal deficits. Premier Giorgia Meloni has prioritized tax cuts and increased defense spending under this framework.

Global Context and Domestic Challenges

In the United States, the ongoing government shutdown has left investors and policymakers reliant on private sector data to gauge the labor market’s health. Recent reports indicate sluggish hiring and limited layoffs, suggesting a cooling job market. The absence of official employment figures from the Bureau of Labor Statistics complicates the economic picture further.

Compounding these challenges, President Donald Trump has enacted new tariffs on a range of wood products, aiming to bolster domestic manufacturing. Canada, as the largest supplier of timber to the US, is poised to face significant economic impacts from these tariffs, which come on top of existing duties.

In Asia, China’s residential home sales showed signs of stabilization in September, nearly three years after the government began implementing support policies for the housing sector. Meanwhile, India experienced its strongest monsoon in five years, which could improve crop yields and alleviate food price pressures.

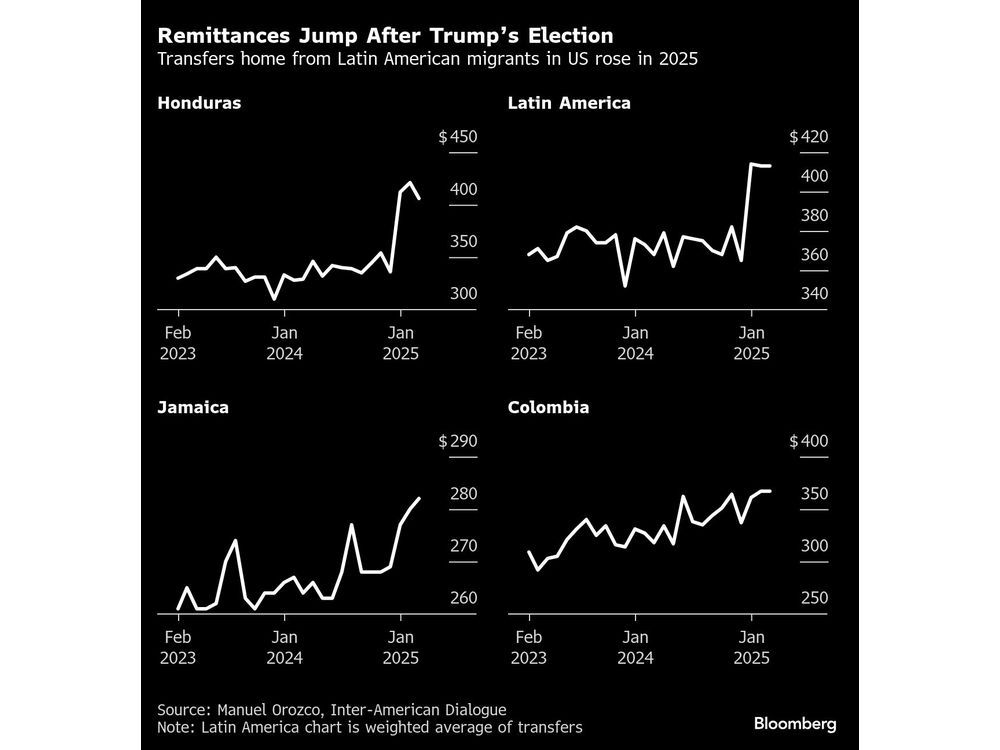

Emerging markets are also feeling the strain. Reports suggest that deportations from the US might lead to billions in lost remittances in the coming years. Conversely, Petroleos Mexicanos, the state-owned oil company in Mexico, is projected to report its largest fiscal deficit in history, estimated at around $31 billion, largely due to falling revenues and extensive bailouts needed to manage its substantial debt.

As the global economic landscape continues to evolve, central banks worldwide are making strategic decisions to navigate these complex challenges. In various regions, including Mozambique and the Dominican Republic, authorities have lowered interest rates in response to economic pressures, while others like Israel and Australia have opted to maintain their current rates.

The fluctuations in inflation and economic policy across Europe, coupled with developments in the US and Asia, underscore the interconnectedness of today’s global economy. Observers will be closely monitoring these trends as they unfold in the coming months.

-

Science4 months ago

Science4 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Health4 months ago

Health4 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Top Stories4 months ago

Top Stories4 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Technology4 months ago

Technology4 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World4 months ago

World4 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle4 months ago

Lifestyle4 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology4 months ago

Technology4 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology4 months ago

Technology4 months agoApple Expands Self-Service Repair Program to Canada

-

Technology4 months ago

Technology4 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology4 months ago

Technology4 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology4 months ago

Technology4 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business4 months ago

Business4 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey