Business

UK Chancellor Reeves Gains £5 Billion Boost Amid Rising Inflation

Chancellor of the Exchequer Rachel Reeves is poised to receive an unexpected financial boost of approximately £5 billion ($6.7 billion) as the UK grapples with persistently high inflation. This increase is anticipated to significantly aid her efforts in addressing the country’s substantial budgetary shortfall, estimated to range between £20 billion and £30 billion. The inflationary environment, while straining the budgets of everyday citizens, is set to enhance government tax receipts, according to a recent analysis.

The analysis by Michael Saunders, a former Bank of England rate-setter and senior adviser at Oxford Economics, reveals that inflation will elevate the taxable value of incomes, profits, and prices in cash terms. As a result, the Chancellor’s fiscal plans will benefit from increased revenue, which outweighs the additional costs associated with servicing the government’s debt. Currently, these costs account for nearly 10% of all government expenditure.

Inflation’s Mixed Impact on Government Finances

While the rise in prices is expected to contribute positively to tax revenues, it also presents challenges for the government. Higher inflation is likely to delay interest rate cuts by the Bank of England, which could keep the cost of debt servicing elevated. Despite this, Saunders asserts that the net increase in tax revenue from higher wage growth and prices, estimated at £9 billion, will surpass the anticipated increase in debt servicing costs, projected at £4 billion.

“The revenue gains from pay and prices outweigh the rise in the cost of servicing costs,” Saunders stated. “So the public finances are net beneficiaries of higher inflation, assuming public spending is fixed.”

The current inflation rate, fueled by surging energy and food prices, is almost double the Bank of England’s target of 4%. Additionally, wage growth, excluding bonuses, remains elevated at just below 5%, although it is cooling compared to previous months. These factors mean that government spending plans are effectively less generous than initially intended. Nonetheless, Reeves has the opportunity to capitalize on the fiscal gains without increasing expenditures to offset the inflationary impact.

Future Fiscal Challenges for the Chancellor

Looking ahead to the upcoming budget on November 26, 2023, economists anticipate that Reeves will need to implement substantial tax increases to restore the limited fiscal flexibility she has against her primary fiscal rule. This rule mandates a balance between day-to-day spending and tax receipts by the tax year 2029-2030. Recent challenges, including higher borrowing and elevated debt-interest costs, have further complicated the public finances since the last fiscal event in March.

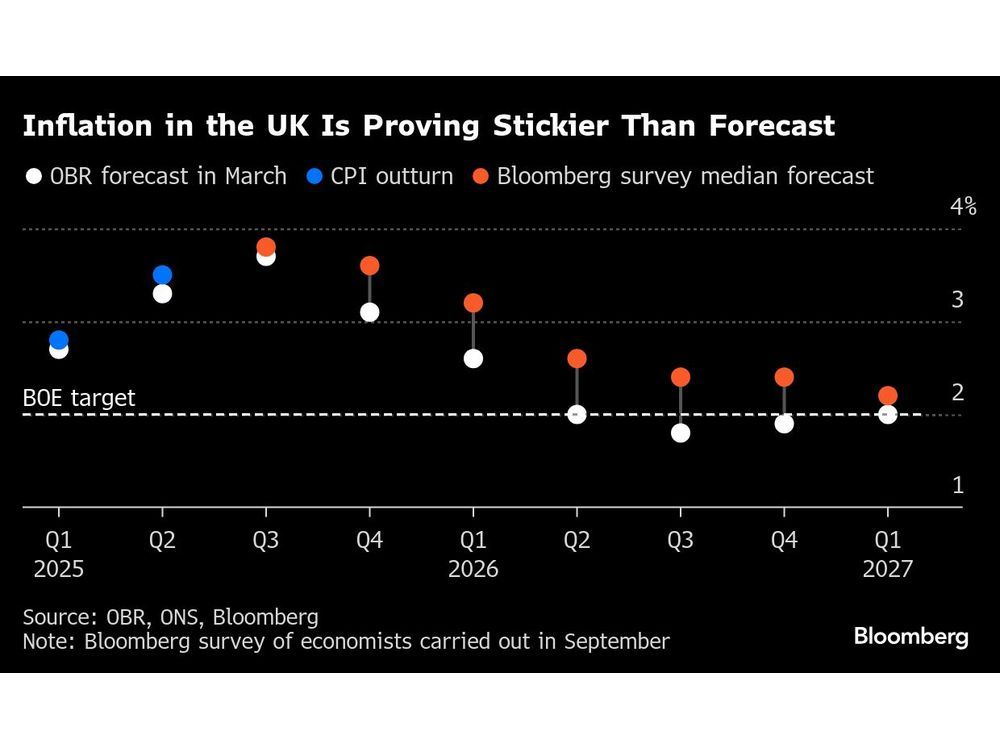

In March, the Office for Budget Responsibility (OBR) projected relatively low growth rates, forecasting pay growth at 2.3% and consumer price index (CPI) inflation at 2.1% by 2026. These forecasts are now expected to be significantly revised upward, aligning more closely with external forecasts from organizations like the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD).

As the Chancellor prepares for the upcoming budget, the inflationary landscape presents both opportunities and challenges. While the boost in tax revenue is welcomed, the complexities of managing public spending and debt servicing remain critical considerations as the UK navigates its fiscal future.

-

Science4 months ago

Science4 months agoToyoake City Proposes Daily Two-Hour Smartphone Use Limit

-

Top Stories4 months ago

Top Stories4 months agoPedestrian Fatally Injured in Esquimalt Collision on August 14

-

Health4 months ago

Health4 months agoB.C. Review Reveals Urgent Need for Rare-Disease Drug Reforms

-

Technology4 months ago

Technology4 months agoDark Adventure Game “Bye Sweet Carole” Set for October Release

-

World4 months ago

World4 months agoJimmy Lai’s Defense Challenges Charges Under National Security Law

-

Lifestyle4 months ago

Lifestyle4 months agoVictoria’s Pop-Up Shop Shines Light on B.C.’s Wolf Cull

-

Technology4 months ago

Technology4 months agoKonami Revives Iconic Metal Gear Solid Delta Ahead of Release

-

Technology4 months ago

Technology4 months agoApple Expands Self-Service Repair Program to Canada

-

Technology4 months ago

Technology4 months agoSnapmaker U1 Color 3D Printer Redefines Speed and Sustainability

-

Technology4 months ago

Technology4 months agoAION Folding Knife: Redefining EDC Design with Premium Materials

-

Technology4 months ago

Technology4 months agoSolve Today’s Wordle Challenge: Hints and Answer for August 19

-

Business4 months ago

Business4 months agoGordon Murray Automotive Unveils S1 LM and Le Mans GTR at Monterey